Sustainability and scale are two of the most important words to us as a donor. JOA are responsible for distributing taxpayers’ money to some of the lowest-income people in the world, and our period of funding for a project is usually only around three or four years. Our goal is to alleviate poverty in the long term, not just during the years when we are contributing funding. We also want the benefits of our projects to be felt by people who aren't directly involved. To achieve this we want to fund projects that tackle the root causes of poverty, challenging the structural and systemic barriers that are preventing people from improving their lives and livelihoods.

We look to fund organisations that genuinely understand the complex market systems in which individuals operate. In this blog I describe an example from a recent monitoring trip with an NGO organisation called Opportunity International in Malawi. Opportunity International (OI) are currently halfway through a three-year financial inclusion project supporting 24,000 people, using a market systems development approach to achieve sustainable and scalable socio-economic impact.

Farming in rural Malawi

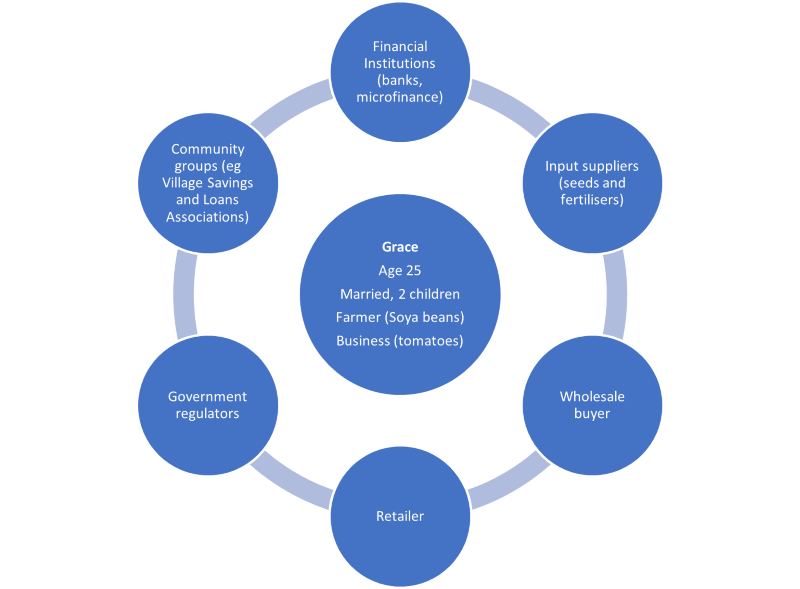

For the purposes of explaining the project, I’m going to use a fictional character, Grace, who I’ve based on the people I met in focus-group meetings and the stories I heard throughout the monitoring trip. Grace is 25 years old with two young children. Grace and her husband are soya bean farmers, and they live in a small house with a thatched roof and no electricity. Grace is part of a women’s savings group in her community which enables her to pool her savings with the other 22 group members and borrow small amounts of cash from the group in the form of group loans. Grace’s aspirations are to own a motorbike so that she can sell her produce further afield. She would also like to own a pig so that she can make her own manure which will help her save money on farming inputs. Her long-term goal is to increase her income so that she can send her children to secondary school and improve her family’s housing conditions.

For Grace to have a successful crop of soya beans this year, she needs to buy good quality input seeds and fertilisers. But Grace does not have enough savings to buy these inputs. If the input suppliers could offer a ‘buy now, pay later’ option to Grace then she could pay them back at the end of the harvest season. Another option would be to ask her savings group for a loan to buy her farming inputs, but the trouble is all the other members want a loan for the same reason and the group has not saved enough cash to lend to all its members. But if the group could take out a loan from a bank, then all the members could share out the loan and buy the inputs that they need for a good farming season. But the banks cannot lend to a group – the government regulator says that a bank is only allowed to lend to groups that are tax registered which this group is not. There is a microfinance company which is not regulated in the same way as the bank, offering a group loan product, but their branch is a long way away and transport is costly.

How can an NGO like Opportunity International help rural farmers be financially included?

Opportunity International's project addresses all these constraints and challenges by helping the financial institutions, the input suppliers, and the savings groups. Thanks to OI’s interventions, Grace has received a loan from a microfinance institution, used quality seeds and harvested a decent crop of soya. Now she needs to sell it. But the roads are poor, and the nearest wholesale buyer is 36km away. She only has a pushbike and cannot transport her produce on a bus. She also doesn’t know which buyers will offer her the best price. OI are also helping Grace’s savings group understand the different available markets to sell their produce at a good price.

Everyone needs to benefit

This is a generic example but what I’ve described, and the different players involved paints a picture of the complicated systems and structures that surround Grace’s life.

All the players involved in Grace’s life need to benefit if the project is to be sustainable. There must be a value proposition for the banks, the buyers, the input suppliers, the government and of course for people like Grace.

Grace herself is at the centre of this market system, and her role is as critical as the other players in the system. She can maximise her income by using farming techniques that will protect her crops from being damaged by extreme weather. She can transport and store her crops in a way that reduces wastage and maintains quality. She can also reduce costs of inputs by making her own organic fertilisers.

Diversifying Grace’s income

The harvesting season for Grace lasts around 40 days. It’s during this period that Grace can monetise her crops. But for the rest of the year, her income is extremely insecure. To provide year-long financial security Grace needs to diversify her income opportunities so that she can earn during the ‘winter’ (off-season) months. To develop an alternative income stream, Grace needs an entrepreneurial mindset. She needs to understand about marketing, advertising, budgeting and how to develop and manage a business. Some of the businesses we saw included tailoring, food crops (tomatoes or sweet potatoes), and organic fertiliser.

How does climate change pose a threat?

Even with an enabling and well-functioning market system there are factors that can pose a threat to achieving impact. Climate change being one. Cyclones and droughts are becoming more common as each year goes by. These climate-disasters can destroy an entire season’s harvest. If the crop fails then Grace will lose her primary source of income. She could also lose her family’s source of food and shelter and may not have the money to repay her loan, which risks her future ability to access loans as she’ll be seen as a credit risk by lenders.

Flooding can also make roads impassable meaning that even if she does have the money she still can’t repay her loan as she can’t physically get to the banking branch.

Creating sustainable economic opportunities

Opportunity International understand the needs and constraints to a level of detail that I can only begin to describe. They are partnering with a range of actors including banks and other financial institutions, local government and input suppliers to strengthen their ability to serve people like Grace whilst ensuring there is a clear value proposition for all of them. OI have created a network of 84 trained “Farmer Support Agents” spread across 4 districts who are reaching over 24,000 rural households between them. These Farmer Support Agents provide training to people like Grace on things like good agricultural practices, business development and financial literacy.

Taking a market systems approach is difficult and sometimes messy. It relies on close collaboration, excellent project management, patience, dedication and a certain amount of grit. But the results speak for themselves as we saw last week how households are making tangible progress towards improving their lives and livelihoods. We also heard from financial service providers about how their loan products are expanding economic opportunities for their lowest-income customers.

Over the course of the project there will inevitably be bumps in the road, but if OI continue to navigate their way through the challenges in the expert way that they have been doing since the start of this project, there is every hope of achieving long term poverty reduction in the most hard-to-reach, rural corners of Malawi.