Background information

Partner: Habitat for Humanity

Duration: 2020-2024

Location: Nepal

Project Partners

| 2 Key MFI Partners | Other Stakeholders |

|---|---|

| Jeevan Bikas | Government of Nepal |

| Mahuli MFI | Nepal Rastra Bank (NRB) |

| Unique Nepal MFI | Nepal Microfinance Banker's Association (NMBA) |

| Forward MFI | |

| Sahara MFI |

What was the problem the project set out to address?

Project Aim: Enhance financial security and ensure safer housing for low-income women in Eastern Nepal, by expanding and ensuring access to finance, and increasing financial literacy

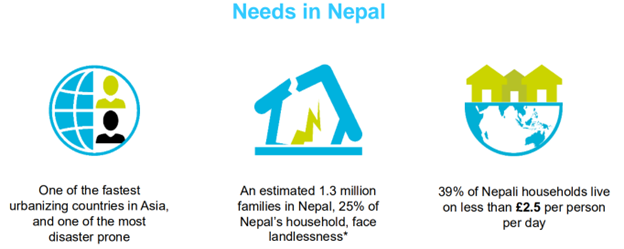

A significant portion of Nepal’s population, especially in rural and suburban areas, live on less than $2 a day, with over half residing in unsafe, inadequate housing, with limited access to formal financial services. Consequently, many rely on informal services which are less reliable and more expensive. Additionally, women in these regions face additional barriers to financial inclusion due to not owning any assets/property which are needed to secure a loan, not having formal identification, a lack of affordable financing options that suit their needs, and low levels of literacy, making it difficult to improve their living conditions—a challenge the project directly addresses.

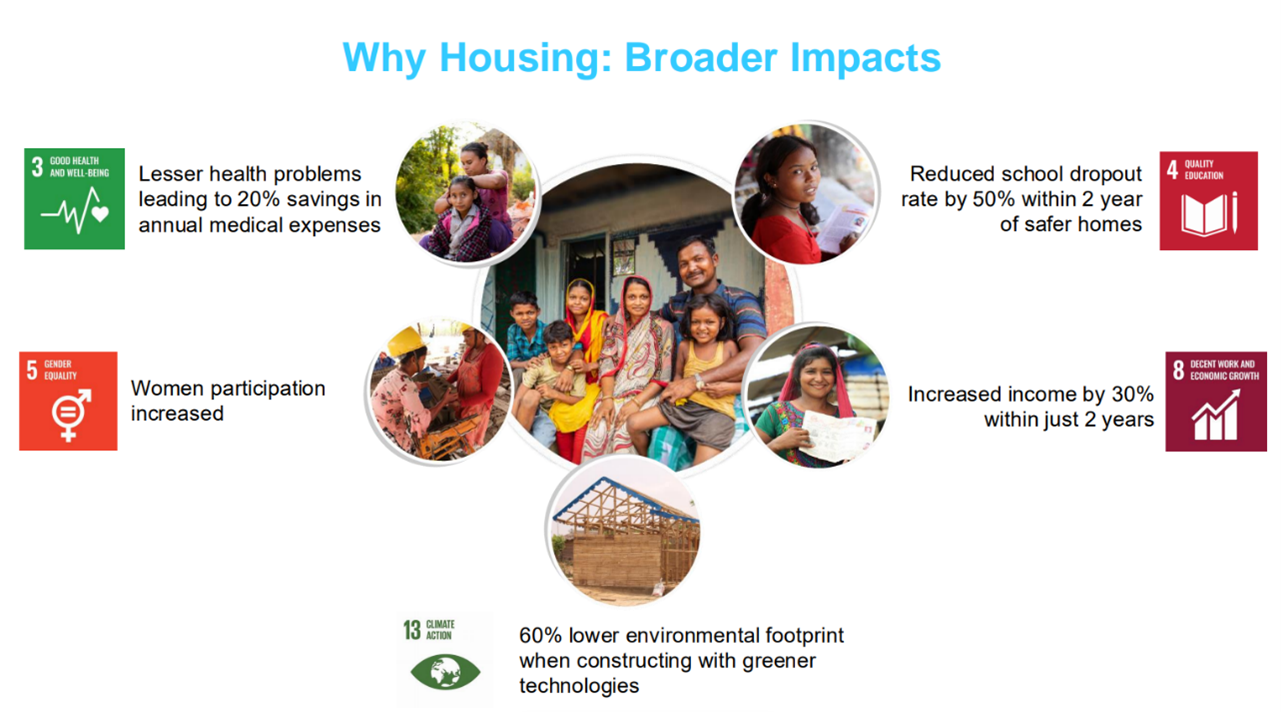

The primary goal of this project was to strengthen Nepal’s finance sector to better address the needs of low-income, rural communities, especially women. This was achieved by building the capacity of the local institutions, tailoring their services to the unique local context. Partnering with five microfinance institutions (MFIs), the project prioritised improving access to housing loans while empowering marginalised women with the knowledge and tools to actively engage in financial processes.

Central to the approach was the commitment to localisation, empowering local actors and organisations to take the lead in development or humanitarian efforts within their region. By improving access to financial services, the initiative aimed to promote economic stability, reduce poverty and drive inclusive economic growth across Nepal.

Project activities and outcomes

By providing capacity building training events, Habitat for Humanity significantly overachieved in educating local MFI staff and clients on key elements of effective financial inclusion, including the use of digital services, microfinance, financial literacy, household budget management and the importance of safe shelter. As a result, 33,007 people across Nepal were trained on the use of digital financial services and 8,406 women were educated in financial literacy, leading to increased initiation of micro-enterprises and a rise in self-employment.

A critical component of the project has been the integration of digital financial services such as online banking (e.g. payments) and online lending (e.g. housing loans), which improved accessibility to financial services by reducing geographic barriers. All partnering MFIs now offer digital financial services, with 136 branches providing the service across Nepal.

To compliment the improved accessibility of financial services, Habitat for Humanity also supported MFIs in designing and refining housing loans products tailored to better meet the specific needs of their customers.

Another key aspect of the project was the delivery evidence-based advocacy to improve regulatory environment by ensuring housing microfinance is recognised as productive loans. Enabling MFIs to deliver client-centric housing loans, expanding access to affordable housing finance and benefiting low-income marginalised communities.

This project enabled 140,000 women from low-income communities to access £125.85m in housing loans. Other notable outcomes include:

- 92% of women reported increased independence in making financial decisions

- 73% of women reported improved financial literacy

- Of the target communities, there was a 96% increase in awareness of safe shelter and housing microfinance loans.

The project boosted demand for (and utility of) financial services (including loans and savings) while simultaneously fostering a better service to low-income clients from financial service providers.

Key facts and figures

| OUTCOME | INDICATOR | BASELINE | ACHIEVED |

|---|---|---|---|

| Low-income women have improved financial security and safer housing through improved access to financial services in Nepal | Number of women from low-income communities accessing housing loans |

0 |

140,000 |

| Percentage of women reporting more independence to make financial decisions |

12.3% |

92% |

|

| Low-income families have increased capacity and awareness regarding accessing microfinance loans for financing and planning their home improvements | Percentage of target population with awareness regarding safe shelter and housing microfinance loans |

46.3% |

96% |

| MFI have increased capacity to offer client-centric housing loans that meet the needs of the clients from marginalised low-income communities | Number of MFIs adopting Digital Financial Services |

0 |

5 |

| Loan capital disbursed as housing loans (In GBP) |

0 |

£125.85m |

|

| Financial literacy training classes are held for 6,000 women to increase knowledge and capacity to access and use microfinance loans. | Number of women receiving financial literacy training |

0 |

8,406 |

| 2 MFIs supported in adopting Digital Financial Services to serve their clients better | No of MFI clients trained on the use of Digital Financial Services |

0 |

33,007 |

| MFI clients received housing loans | Number of housing loans disbursed |

0 |

140,000 |

Challenge and lessons learnt

COVID-19 impacted the operations of organisations worldwide. The same was true in Nepal, especially for microfinance institutions. This was felt by the project as co-ordination and collaboration with the local government and stakeholders became more challenging. However, resilience and adaptability were key to overcoming these obstacles, allowing the project to continue without delays.

In addition, the emergence of organised anti-microfinance groups contributed to negative perceptions of microfinance institutions. In response, Nepali MFIs (including those partnered to the project), along with NRB and NMBA enhanced their education programmes and capacity-building activities. As a result, they successfully mitigated negative perceptions towards microfinance institutions.

The women-centric model for awareness and literacy training had to be adjusted, as men or husbands needed to be involved due to household-level decision-making dynamics.

Refresher courses are essential for sustained learning, not only to reinforce basic financial literacy but also to help participants adapt to the evolving economic landscape.

As a result of the project 140,000 women and their associated housing loans, were disbursed, with a large focus on women, now have access to financial services.

Case Study

By Sahara Nepal - Year 4

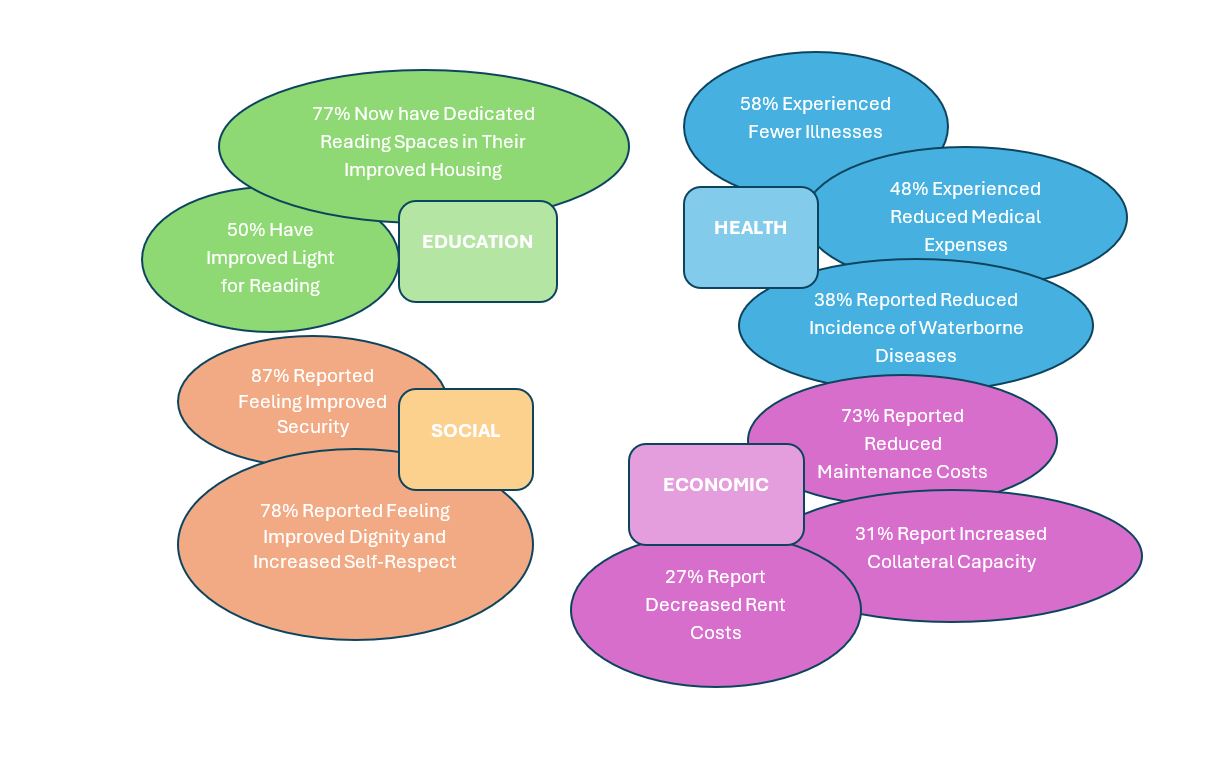

In years two and four of the project, a case study was conducted by Sahara Nepal. The results illustrated in the diagram below highlight the various impacts the project has had on the community they service. These outcomes demonstrate how housing microfinance can serve as a transformative tool for holistic development, benefiting individuals, families, and the broader community.

Key, overarching outcomes include:

- 92% have experience health improvements due to improved housing

- 83% of respondents report educational advantages from improved housing

- 95% of respondents have experienced economic benefits from improved housing

- 97% have seen some social improvements due to upgrading housing